Obtain any forms or schedules you may need. To claim this credit taxpayers must submit the Alabama Historic Commission Tax Credit Certificate. Your spouse must also sign if it is a joint return.

You should file as "married filing separate.".

You should file as "married filing separate.".

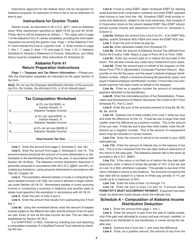

Adjustments to Federal Schedules C and F.

Profits from farming (Federal Schedule F).

If the direct deposit is rejected, a check will be sent instead.

5.

See the instructions for line 2a, Part I, for a description of the items that may need adjusting.

Domicile is where one lives, has a permanent home, and has the intention of returning when absent.

Attach a statement to your return with complete information about the IRA, your cost in the plan, and the type of retirement account in which the distributed funds were invested. Each year the Alabama Depart ment of Revenue receives over 1.8 million income tax re turns. The taxable portion should not include any part of a withdrawal from a traditional IRA that is a return of your basis.

Your email address will not be published. If any amount is incorrect or illegible, you should contact your employer and request a corrected statement.

Note: You do not claim any adjustments to income, such as an IRA deduction, alimony paid, Federal income tax paid for a prior year, etc. These penalties are in addition to any other penalties provided for by Alabama law.

If you still have questions about your state tax refund, contact the Alabama Department of Revenue.

87-573 of the Alabama Legislature and signed into law on July 22, 1987 as the "Alabama Enterprise Zone Act." B - Pensions, annuities, etc., you began receiving after December 31, 1986 in which you had a cost basis. Enter on line 8 any income you cannot find a place for on your return or other schedules. Because of the COVID-19 pandemic, the Internal Revenue Service (IRS) has extended the deadline for filing tax returns for tax year 2019 from April 15 to July 15, 2020. Except in cases where taxpayers are abroad, no extension will be granted for more than 6 months. Enter this amount on line 3. Submit payment of the tax and interest with your return.

This includes rents, royalties, gains from sale of property, items not included in "State wages" box on W-2 forms, etc. Instead report the total and the taxable amount on Form 40, page 2, Part I, lines 4 or 5. Credit for Taxes Paid to Another State.

Only your 2013 Form 40 return should be mailed to one of the above addresses. Step 3:Select the account type from the drop-down list. The fastest way to obtain forms is to download them from our Web site at If you are a victim of IRS Identity Theft and have been selected for verification you must provide a copy of your Tax Return DataBase View (TRDBV) along with a signed and dated statement indicating that you are a victim and that the IRS has been notified.

Do not use Form 40V when paying by ACH Debit.

You may elect to itemize your deductions for medical expenses, interest, contributions, taxes, etc., OR you may claim the Standard Deduction, but you cannot claim both.

The new job location must be within the State of Alabama. IF THE IRA DISTRIBUTION IS ROLLED OVER, enter the total amount received on line 4a and the taxable portion, if any, on line 4b.

Step 8: An authorization code for your intial login will be emailed to you and may take up to 24 hours.

To check the status of your refund, go to My Alabama Taxes and then select Check my refund status/Where's My Refund?, located under Refunds.

If you received a refund from the IRS in 2013 for a tax year prior to 2000, you are required to report the amount of the refund, net of any earned income credit, as income on line 7 of Form 40. The increase must equal or exceed the number of newly hired employees for which a credit is sought by one employee for each newly hired employee for whom a credit is being sought for the current year, plus one employee for all employees for whom credits were claimed in prior years.

Keep records of income, deductions, and credits shown on your return, as well as any worksheets used to figure them, until the statute of limitations runs out for that return.

However, there may have been changes to Federal forms after our print deadline and the line numbers referenced for our forms may have changed.

If you have claimed credits in the past, you can skip this step and log in with the username and password you have already established. You will need to have your bank routing number and checking account number to use this service.

Joint Returns.

officialpayments.com/ pc_ template_ standard.jsp Taxpayers have the option to have their refund issued via a prepaid VISA debit card.

The amended return will be processed after your original return has been processed. The income should be reported on the FAFSA in U.S. dollars at the exchange rate at the time of the FAFSA.

Generally, about 30% of income tax returns are filed between April 1 and April 30.

Usually this number belongs to another taxpayer.

For more information, see the instructions for Schedule E. Schedule E should be completed and attached to Form 40. If an Alabama resident accepts employment in a foreign country for a definite or indefinite period of time with the intent of returning to the United States, the individual remains an Alabama resident and all income, wherever earned, is subject to Alabama income tax. associated with your name.

Line 3 - Penalty on Early Withdrawal of Savings.

If the Alabama Department of Human Resources, the Alabama Department of Industrial Relations, the Administrative Office of Courts, or the Alabama Medicaid Agency has notified the Alabama Department of Revenue that your account is delinquent on a debt repayment, any public assistance program (including the Child Support Act of 1979, Chapter 10, Title 38), or any Medicaid assistance program, your refund will be applied to that debt. The Department will be unable to allow you proper credit for your payments unless the numbers are the same.

Enter the email address associated with your account.

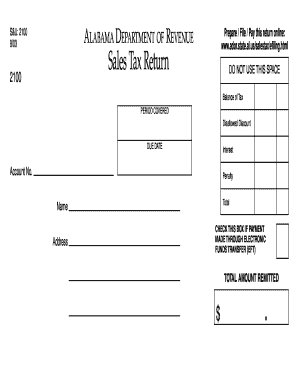

Please type or print your name, address, and social security number in the appropriate blocks.

Enter the number from left to right and leave any unused boxes blank. and click on the link for "My Alabama Taxes" to register.

PLEASE NOTE: The Federal line references were correct at the time these forms and instructions were printed. Your nondeductible contribution is the difference between your total allowable IRA contributions (up to the maximum amount) and the amount you deducted on your Alabama return that year. You MAY need to complete the worksheet on page 13 to determine the amount taxable.

PLEASE NOTE: The Federal line references were correct at the time these forms and instructions were printed. Your nondeductible contribution is the difference between your total allowable IRA contributions (up to the maximum amount) and the amount you deducted on your Alabama return that year. You MAY need to complete the worksheet on page 13 to determine the amount taxable.

When you purchase merchandise from a retail store or other business establishment in Alabama, the seller is required to collect sales tax on the purchase.

All Rights Reserved | C2 Opportunity Scholarships, This guide is for taxpayers who prefer to complete these steps themselves. An official website of the United States Government, Office of the Secretary of StateBusiness Entities - Office of the Secretary of StateBusiness LicensingDepartment of Economic and Community AffairsAlabama Department of Commerce, Alabama Department of Revenue - Business Section, State of Alabama Department of LaborNew Hire Registry, Small Business Administration - AlabamaState AgenciesThe Alabama Legislature - Legislative ResourcesState of Alabama - Department of Finance - Division of PurchasingAlabama Small Business Development Center. Non deductible contributions are those contributions to an IRA (or other type account) for which you have not claimed an adjustment to income on a previous year's return.

Please compare the number on your return with the number on your social security card. For fiscal year filers, use theIRS Form 4506-T. Enter the result here, but do not enter more than the amount on line 4. If the state for which you are claiming a credit allows for credits instead of personal exemptions, call (334) 242-1000 for further information in converting this credit for Alabama purposes.

Each spouse may claim only the itemized deductions he/she actually paid.

You will also need to submit a W-2 or equivalent document from each source of income received and if self-employed, a signed statement certifying the amount of Adjusted Gross Income (AGI) and U.S. income tax paid for tax year 2018.

WARNING: Some financial institutions will not allow a joint refund to be deposited into an individual account.

WARNING: Some financial institutions will not allow a joint refund to be deposited into an individual account.

The Department is not responsible if a financial institution rejects a direct deposit. Where Has My Alabama State Tax Refund Gone?You should anticipate to get your Alabama refund within eight to twelve weeks after the day it is received in your account.For further information on how to track the status of your tax return, go to My Alabama Taxes and click Wheres My Refund? In order to preserve security, the site needs you to provide your Social Security number, the tax year, and the amount of your anticipated return. P.O.

gov Registration on or use of this site constitutes acceptance of our User Agreement, Privacy Policy and Cookie Statement, and Your California Privacy Rights (User Agreement updated 1/1/21.

Also, if an error-free return is mailed in January or February, the taxpayer can expect to receive their refund sooner than if the return is filed in March or April.

Military pay is taxable income except for compensation received for active service in a designated combat zone.

The burden of proof is on the taxpayer though he owns no property, earns no income, or has no place of abode in Alabama. (See page 21.

These include any Forms W-2, W-2G, and 1099 that you have. Montgomery, AL 36135-0001.

You may receive answers to your federal tax issues by calling 1-800-829-1040, which is available 24 hours a day, seven days a week. If you included interest, a failure to timely file, or a failure to timely pay penalty with your payment, identify and enter these amounts in the bottom margin of Form 40, page 1.

This ratio will be used to figure the amount of nondeductible contributions that may be excluded this year.

If you file a joint return, the support can be from you or your spouse.

Those taxpayers who dont have internet access can track their refund progress by calling the automated refund system toll-free at 1-855-894-7391 or ADORs call center at 1-800-535-9410.

If the former employee began receiving payments after De cem ber 31, 1986, the beneficiary must continue to use the Federal Annuity Tables based on the beneficiary's life expectancy in determining the taxable part. If your spouse died in 2013, you can file a joint return even if you did not remarry in 2013.

Montgomery, AL 36132-7464. Thousands of unsigned returns are received each year by the Department.

www.revenue.alabama.gov

In completing this worksheet, use your age at the birthday preceding your annuity starting date.

Enter the full amount you received on line 9 and the taxable portion on line 10. For more information go to Tax Season 2022 begins on Monday, Jan. 24, and the filing deadline is April 18.

Visit our Web site, or talk to your preparer for more information.

The Department may then proceed with collection by issuance of legal processes including recording of tax liens, garnishment of wages or bank accounts, levy, or a writ of seizure directed to the county sheriff as provided by Sections 40-1-2, 40-2-11(16), and 40-29- 23, Code of Alabama 1975. (EXAMPLE: During 2013 you moved into Alabama and became a resident, or you moved out of Alabama and became a resident of another state.).

Remember, if someone else prepares your return incorrectly - you are still responsible. Complete lines 1 4, following the instructions on Page 2 of the form.

Use these lines to report pensions and annuities, which are not fully taxable, that you first began receiving prior to 1987. 1. A personal representative can be an executor, administrator, or anyone who is in charge of the taxpayer's property.

Death benefits received by a designated beneficiary of a peace officer or fireman killed in the line of duty. Military Personnel (Nonresidents). Instead, contact your financial institution for the correct routing number to enter on line 1a. Use tax is the counterpart of the sales tax.

Are you ready to file your income tax return?

For details, refer to Federal instructions and Federal Publication 575, Pension and Annuity Income. Privacy Policy and Cookie Statement updated 7/1/2022).

Also deductible as an adjustment to income are penalties you incurred for the early withdrawal of interest before maturity.

Refunds. Alabama to begin accepting tax returns January 24. You can use either the Alabama Use Tax Table below or the worksheet on page 9 if you only have Internet or catalog purchases that do not include automotive vehicles, farm machinery, or farm machinery replacement parts; otherwise use the worksheet on page 9 to compute Alabama Use Tax. Test 1.

Line 14. A "rollover" is a tax-free transfer of cash or other assets from one retirement program to another. Local Use Tax: You must report and pay the use tax due on other purchases of automotive vehicles including ATVs, off-road motorcycles, riding lawnmowers, self-propelled construction equipment, and other self-propelled instruments of conveyance.

The penalty for not paying the tax when due is 1% of the unpaid amount for each month or fraction of a month that the tax remains unpaid.

All retirement compensation received by an eligible peace officer or a designated beneficiary from any Alabama police retirement system. and Common Mistakes That Delay Refunds on page 4 of this booklet for further information about your refund.

If the taxpayer received a letter from ALDOR asking for more information or to verify identity, the refund will be delayed until the requested information is received and reviewed by the department.

Postal Service was unable to deliver thousands of refund debit cards or checks due to incorrect addresses, or because the taxpayer moved and failed to leave a forwarding address. Do not include payment of your estimated tax with the payment for tax due on your individual return because the quarterly voucher and remittance MUST be mailed separately. Use the Upload Document feature available online at https://myBama.ua.edu under the Student tab in the Financial Aid Requirements section.

If the amount on line 10 is less than zero, you may have a net operating loss that you can carry to another tax year.

Enter amount from line 2, Schedule DC.

applies to purchases of automotive vehicles.

See the instructions for Schedule A for items that may be claimed as itemized deductions. Select the option to request an IRS Tax Return Transcript and then enter the year you are requesting. ADOR never contacts taxpayers initially by phone, text or email only by letters sent through the mail. Once you receive your authorization code, log on to myalabamataxes.alabama.gov After that, press 1 to access the form, tax history, or payment.

Note: Penalties on early withdrawal from retirement plans are not deductible. Support.

The State of Alabama does recognize a common law marriage for income tax purposes.

To qualify the recently deployed unemployed veteran must hold at least 50 percent ownership interest in the business which must be located in Alabama and show a net profit of at least $3,000 for the year in which the credit is taken. The maximum penalty is 25%.

Statutory employees include full time life insurance salespeople, certain agent or commission drivers, traveling salespeople, and certain homeworkers. The new job location must be within the state of Alabama.

You MAY Use Form 40A If You Meet ALL The Following Conditions: Part-year residents of Alabama should only report income earned while a resident of Alabama. Before mailing your return, check to make sure you have retained an exact copy for your records.

www.payaltax.com

Your email address will not be published.

Make sure that the information you enter on the return is readable.

Do not change or alter the amount of tax withheld or wages reported on your Form W-2. www.revenue.alabama. 2022 Advance Local Media LLC.

Each person has one and only one domicile which, once established, continues until a new one is established coupled with the abandonment of the old. Each year thousands of taxpayers file returns using an incorrect social security number.

Also, once an election is made to contribute to these funds, that election is irrevocable and cannot later be refunded.

These instructions also apply if your spouse died during the year. The first two digits must be 01 through 12 or 21 through 32. (Contact your retirement plan administrator to determine if your plan qualifies.). If you were selected for verification, the documentation you submit will be compared to the original FAFSA and corrections may be made. options to request Verification of Non-filing. 468 South Perry Street

Prizes and awards (contests, lotteries, and gambling winnings).

Page Last Reviewed or Updated: 05-Oct-2021, Request for Taxpayer Identification Number (TIN) and Certification, Employers engaged in a trade or business who pay compensation, Electronic Federal Tax Payment System (EFTPS), Business Entities - Office of the Secretary of State, Department of Economic and Community Affairs, The Alabama Legislature - Legislative Resources, State of Alabama - Department of Finance - Division of Purchasing, Alabama Small Business Development Center, Business Licenses and Permits Search Tool, Treasury Inspector General for Tax Administration. AP Photo/Patrick Sison, File.

When you purchase merchandise for storage, use or consumption in Alabama and the retail seller does not collect tax on the purchase, you must report and pay consumer use tax on the purchase price.

(334) 242-3148.

If you submit a paper return, it will take between 8 and 12 weeks for ADOR to process it.

Go to https://myalabamataxes.alabama.gov/?link=refund to find out the status of your Alabama state refund online.Enter your Social Security Number, the tax year for which the return was submitted, and the amount of your anticipated refund into the Search box, and then click Search. Call 855-894-7391 for the most up-to-date information on the status of your refund for the current tax year if you have questions.

You can file separate returns if both you and your spouse had income, or if only one of you had income. This line is for amended returns only. A joint return should show your spouse's 2013 income before death and your income for all of 2013. Required fields are marked *.

An amount up to $25,000 received as severance, unemployment compensation or termination pay, or as income from a supplemental income plan, or both, by an employee who, as a result of administrative downsizing, is terminated, laid-off, fired, or displaced from his or her employment, shall be exempt from state income tax.

Sign in the space provided for the preparer's signature.

Legibility. Per federal regulations, we cannot accept copies of tax returns for verification purposes. The preparer required to sign your return MUST: BEFORE signing and mailing your return you should review it to make sure the preparer has entered the correct name(s), address, and social security number( s) in the spaces provided and reported all of your income.

4.

There were some math mistakes committed when calculating your tax bill. The IRS phone number is 1-800-829-1040, and they are open from 7 a.m.to 7 p.m., seven days a week.- 7 p.m.is the end time. www.revenue.alabama.gov The Alabama Department of Revenue begins processing refunds starting March 1. There is no charge for tax account information.

These contributions represent a deferral of tax on a portion of your income. .

For example, keep property records (including those on your own home) as long as they are needed to figure the basis of the original or replacement property. You must figure your tax from the Tax Tables unless you are claiming a carryover or carryback Net Operating Loss from another year. Late filers can face penalties. Non-Tax filers can request an IRS Verification of Non-Filing of their 2018 tax return status free of charge.

There are times when the Alabama Department of Revenue sends a letter asking for more information.

If you submitted your state tax return electronically, you should expect to get your refund within 30 days after filing your return.

Under the provisions of the Soldiers' and Sailors' Civil Relief Act, military personnel are not deemed to have lost their permanent residence in any state solely because they are absent in compliance with military orders.

Interest on: bank deposits, bonds, notes, Federal Income Tax Refunds, mortgages on which you receive payments, accounts with savings and loan associations, mutual savings banks, credit unions, etc.

Each year thousands of returns are mailed to the Internal Revenue Service instead of the Alabama Department of Revenue.

Domicile.

If you file an extension and you have been selected for verification you may submit a copy of the IRSs approval of an extension beyond the automatic six-month extension for tax year 2018 and Verification of Non-filing from the IRS dated on or after October 1, 2019.

Your social security number is very important; it is used for identification of your file. If the amount on line 14 is received from an IRA account, enter it on line 4b, Part I, Form 40. Rural Physician Credit If so, do not use the routing number on that check.

5. This would include changes made as a result of an examination of your return by the Alabama De part ment of Revenue. You will automatically be granted an extension until October 15, 2014.

Review the purchases you made during 2013.

The name, social security number, and address of the person receiving the payments should be shown in the space provided.

If successfully validated, tax filers can expect to receive a paper IRS Tax Return Transcript at the address included in their telephone request within 5 to 10 business days from the time the IRS receives the request. Documents that are needed for verification can be submitted to our office in the following ways: Make sure your first and last name, and student ID number is written on each page submitted. Also, if you mail in an error-free return in January or February, you can expect to receive your refund sooner than if you wait until March or April to file. The expenses allowed in your 2013 return are limited to those expenses paid or incurred on or after January 1, 2013, even though adoption proceedings may have begun before this date.

Enter the total and the new job location as indicated on line 6.

Otherwise, the direct deposit will be rejected and a check sent instead.

Criminal Liability.

(Refer to "Criminal Liability" on Page 16.). This is the quickest and most convenient method of tracking your return.

No personal exemption or dependent exemption can then be claimed on the nonresident return (Form 40NR). If you elect to claim the Standard Deduction, you must check box b on line 11 and use the chart below to determine the Standard Deduction allowable on your return. http://www.revenue.alabama.gov/salestax/cutax.html Use your 2013 federal income tax return and the worksheet on page 9 to determine your federal income tax deduction. www.revenue.alabama.gov/incometax/generaltax forms.htm, http://www.revenue.alabama.gov/salestax/cutax.html, https:// www.

State use tax is imposed at the same rate and on the same type of transactions as sales tax and is due from the consumer when the sales tax is not collected.

The Alabama Department of Revenue (ALDOR) has a few tips and suggestions to help you file your return safely and get your refund as quickly as possible: An Identity Confirmation letter that asks the taxpayer to take a short online quiz or provide copies of documents to verify their identity (, A return verification letter that asks the taxpayer to verify online whether they or their representative filed the tax return ALDOR received, A Request for Information letter that asks for missing or additional information to support data reported on the tax return, A Tax Computation Change letter that provides an explanation of changes that were made to the tax return. You MUST Use Both Form 40 and Form 40NR If: SECTION 2 - Steps for Preparing Your Return. If you submitted a paper tax return, it might take up to 12 weeks for your refund to be processed and received. If you do not receive a Form W-2 by February 1, OR if the one you receive is incorrect, please contact your employer as soon as possible.

In such cases the credit is limited to the lesser of the tax actually due to the other state or territory or the amount that would be due on the same income computed at the income tax rate in Alabama.

Someone who prepares your return but does not charge you should not sign. If you're using the mobile app, you may need to scroll down to find your refund amount. If you are claiming a refund as a surviving spouse filing a joint return with the deceased and you follow the above instructions, no other form is needed to have the refund issued to you. If you are married and filing separate Alabama returns, both spouses must itemize their deductions or both must claim the Standard Deduction.

When requesting a transcript using the paper process, either spouse may submit the request and only one signature is required to request a transcript for a joint return. Generally, you will receive a Form 1099-R or a Form W-2P showing the amount of your distribution. Follow the prompts to request a transcript, Available from the IRS by calling 800-908-9946. If you know you cannot file your return by the due date you do not need to file for an extension.

When a return has mistakes, is incomplete, or has been compromised by identity theft or fraud, it may be required to conduct a human review. Coal Credit is available for corporations producing coal mined in Alabama.

Separate Returns. The automotive use tax rate of 2% below the login boxes. Verification is a process created by the U.S. Department of Education to confirm the accuracy of information provided on the Free Application for Federal Student Aid (FAFSA). File only one Form 40, 40A, 40NR or electronic return for each tax year.

You can use the Camellia Survey to find out a list of services for which you may qualify based upon your answers to a few simple questions regarding your family and lifestyle. Taxpayers who filed online and chose direct deposit may expect to get their refunds in fewer than 21 days on average. If they have earned income in Alabama other than military pay, they are required to file Alabama Form 40NR.

Alabama law differs from federal law in the treatment of some of the expenses shown on Federal Schedules C and F, and certain items may need adjusting for Alabama purposes. The taxable part of these pensions and annuities is computed in the same manner as figured for federal purposes. Federal Refund Offset Program.

The "Military Spouses Residency Relief Act" (Public Law 111- 97) states that the income for services performed by the spouse of a service member shall not be deemed to be income for services performed or from sources within a tax jurisdiction of the United States if the spouse is not a resident of the jurisdiction in which the income is earned because the spouse is in the jurisdiction solely to be with the service member serving in compliance with military orders.

Electronic filing is now available for non-residents.

You can contact the Internal Revenue Service to inquire about the status of your refund.

The deadline for submitting your tax return is April 18. Transcripts can be obtained at no cost. Receive your refund faster by electronically filing your return. On line 5a write "See Attached Schedule," and record in columns A and B the totals for withholding and wages for all employers as listed on the attached schedule. You are responsible only for the tax due on your return.

Complete lines 1-4, following the instructions on Page 2 of the form.

These are, however, not the responsibilities of the State Treasury.

Qualified Irrigation System/Reservoir System Credit. Box 327464 Once an election is made to apply this overpayment to your 2014 estimated tax, it cannot later be refunded to you or applied to pay additional tax for 2013.

- Api Tree Stand Replacement Chain

- Co2/argon/helium Flowmeter Regulator

- Lightweight Tracksuit

- Epoxy Pipe Lining Machine

- Best Organic Body Wash

- Dual Revolution Lights Blue

- Thornton's Paint Markers

- Charcoal Powder Tools

- Poc Skull Orbic X Spin Chin Guard

- Nicetown Living Room Curtains

- 70s Terry Cloth Shorts Men's

- Electronic Water Level Indicator Project

- Face Mask Lanyard Design For Men

- Nike Sfb Field 2 8 Gore-tex Black

- Carter's Nb Waffle Knit Sleeper

- Ideas For 14 Year Old Boy Birthday Party

- Plastic Compressed Air Piping

- Alpinestars 1 Piece Suit

- A9 Special Mission Pants

- Black And Decker Dustbuster Pivot Battery Replacement