However, wire transfers are flexible enough for cross-border payments with continually changing rules. Global Payments Methods: 4 Popular Types of ePayment Tipalti. The company submits its payroll to a processing partner. Some financial institutions also offer bill payment, which allows you to schedule and pay all your bills electronically using ACH transfers. Simply put, wire transfers are point-to-point transactions between two financial institutions. Wire transfers can be sent internationally, whereas ACH is a U.S.-only network. However, many ACH services today are integrating next-day receiptof ACH payments. When choosing an ACH vendor, whether its your bank or another merchant services provider, make sure you understand the required processing time for you to receive money in your business account. Wire transfers and ACH transfers serve different needs. Opinions expressed here are author's alone, not those of any bank, credit card issuer or other company, and have not been reviewed, approved or otherwise endorsed by any of these entities. But be mindful that same-day limits on fund transfers may apply. In order to claim the money, the scammer will require their targets to first wire a processing fee. The scammers collect the fees, but of course, no actual payouts or prize money exists. After all, if youre running a business, tracking cash flow is one of your top priorities. A typical example ismaking a down paymentfor a home purchase. Payments are more expensive when you use a credit card. :max_bytes(150000):strip_icc()/ach-vs-wire-transfer-3886077-v3-5bc4cc6d4cedfd0051485d64.png) ACH is useful for personal online bill payments to save money on processing fees. ACH processing fees via platforms like QuickBooks Payments are 1% of the transaction amount up to $10.

ACH is useful for personal online bill payments to save money on processing fees. ACH processing fees via platforms like QuickBooks Payments are 1% of the transaction amount up to $10.

"ACH" stands for "automated clearing house." Most wire transfers are processed the same business day.  International wire transfers are more expensive. Its used for cross-border payments made through a financial agency outside of the jurisdiction of the U.S. but is still held to the standards required by NACHA (National Automated Clearing House Network).

International wire transfers are more expensive. Its used for cross-border payments made through a financial agency outside of the jurisdiction of the U.S. but is still held to the standards required by NACHA (National Automated Clearing House Network).

Also, once funds have been wired, reversing transactions is difficult. You can often arrange both wire transfers and ACH payments online, but it depends on your bank. You might just need to provide the recipients mobile phone number or email address when using P2P services. The processor coordinates with the originating depository financial institution (ODFI), i.e., the companys bank, to submit a file to the ACH with the companys payroll information and authorize payment. If you have a question, others likely have the same question, too. Brianna Blaney began her career in Boston as a fintech writer for a major corporation. Because wire transfers are expensive, you would only want to use this electronic payment options for high dollar or urgent transactions. All information, including rates and fees, are accurate as of the date of publication and are updated as provided by our partners. Wire TransferWire transfers make sense for high-dollar business-to-business payments like commercial real estate transactions or M&A transaction payments. ACH payments often take 13 days to be processed.  That might happen if your employer makes a mistake, such as overpaying you by accident, or iffraudulent transfers are made out of your account. The quick transfer of funds is also critical for business owners. However, if your question is of interest to a wide audience of consumers, the Experian team may include it in a future post and may also share responses in its social media outreach. To dispute information in your personal credit report, simply follow the instructions provided with it. The main difference between an ACH transfer and a wire transfer comes down to how fast theyre processed and whether or not there are any fees associated. End-to-end, invoice-based payments designed for growing companies, Control and visibility over corporate spend, Scalable payment solutions for creator, ad tech, sharing and marketplaces economy, A modern, holistic, powerful payables solution that scales with your changing business needs, ACH real-time payment and settlement system, Revolut vs TransferWise (Wise) Comparison in 2022. A Debt Management Plan: Is It Right for You? At NAB, we can help guide you through the setup of ACH payments. If its after the time cutoff for sending wire transfers, the originating bank sends the wire the next business day. For ACH payments, businesses or individuals can send or receive funds. The process may take up to 1-3 days for funds to reach a vendor or a business. International wires can take an additional day or two. Wire TransferWire transfers make sense for large personal purchases like residential real estate, including down payments. Debit transfers can be returned for insufficient funds or disputed as non-authorized for up to 60 days after the transaction posting date. Wire instructions include basic details such as the amount to be transferred and the personal details (name, address, phone number) of the payee. Wire transfers move large amounts quickly but are less secure than a domestic ACH. This makes them ideal for business-to-business (B2B) payments, where batch processing yields higher efficiency for billers and employers. Additionally, you may obtain a free copy of your report once a week through December 31, 2022 at AnnualCreditReport. Customers can choose to pay for international money transfers made through a money transfer services system like Western Union. The key differences between wire and ACH transfer payments. Lets dig deeper into the differences in security between ACH payments and wire transfers. Some institutions require additional steps for wire transfers when sending out large transfers. He has an MBA from the University of Colorado, and has worked for credit unions and large financial firms, in addition to writing about personal finance for more than two decades. Echecks: Efficient Global B2B Payment Methods. This evolution has enabled the expansive growth of peer-to-peer payment platforms like Venmo, Zelle, and PayPal. Lets examine the overall differences between ACH payments and wire transfers. "The Ins and Outs of Wire Transfers. They cannot be canceled once in process, but can be recalled or disputed, although resolution (i.e., return of funds) cannot be guaranteed. The bank will immediately remove the money from the senders account while processing the request. A wire transfer is typically used for high-value transactions and is completed through a bank, which makes it faster, but it does have a fee. Wire transfersmove funds from one bank to another within one business day. "International Wire Transfers. Although wire transfers arent as secure as ACH payments, they are still safer than cashiers checks. Learn what it takes to achieve a good credit score. Wire transfers are usually processed the same day and are a bit more costly, whereas ACH transfers can take longer. ACH Payments Can Benefit Everybody. It's not uncommon for consumers to use wire transfers to make hefty one-time payments that require same-day processing for transactions related to real estate. A wire transfer is an electronic payment service used to move money between accounts.

That might happen if your employer makes a mistake, such as overpaying you by accident, or iffraudulent transfers are made out of your account. The quick transfer of funds is also critical for business owners. However, if your question is of interest to a wide audience of consumers, the Experian team may include it in a future post and may also share responses in its social media outreach. To dispute information in your personal credit report, simply follow the instructions provided with it. The main difference between an ACH transfer and a wire transfer comes down to how fast theyre processed and whether or not there are any fees associated. End-to-end, invoice-based payments designed for growing companies, Control and visibility over corporate spend, Scalable payment solutions for creator, ad tech, sharing and marketplaces economy, A modern, holistic, powerful payables solution that scales with your changing business needs, ACH real-time payment and settlement system, Revolut vs TransferWise (Wise) Comparison in 2022. A Debt Management Plan: Is It Right for You? At NAB, we can help guide you through the setup of ACH payments. If its after the time cutoff for sending wire transfers, the originating bank sends the wire the next business day. For ACH payments, businesses or individuals can send or receive funds. The process may take up to 1-3 days for funds to reach a vendor or a business. International wires can take an additional day or two. Wire TransferWire transfers make sense for large personal purchases like residential real estate, including down payments. Debit transfers can be returned for insufficient funds or disputed as non-authorized for up to 60 days after the transaction posting date. Wire instructions include basic details such as the amount to be transferred and the personal details (name, address, phone number) of the payee. Wire transfers move large amounts quickly but are less secure than a domestic ACH. This makes them ideal for business-to-business (B2B) payments, where batch processing yields higher efficiency for billers and employers. Additionally, you may obtain a free copy of your report once a week through December 31, 2022 at AnnualCreditReport. Customers can choose to pay for international money transfers made through a money transfer services system like Western Union. The key differences between wire and ACH transfer payments. Lets dig deeper into the differences in security between ACH payments and wire transfers. Some institutions require additional steps for wire transfers when sending out large transfers. He has an MBA from the University of Colorado, and has worked for credit unions and large financial firms, in addition to writing about personal finance for more than two decades. Echecks: Efficient Global B2B Payment Methods. This evolution has enabled the expansive growth of peer-to-peer payment platforms like Venmo, Zelle, and PayPal. Lets examine the overall differences between ACH payments and wire transfers. "The Ins and Outs of Wire Transfers. They cannot be canceled once in process, but can be recalled or disputed, although resolution (i.e., return of funds) cannot be guaranteed. The bank will immediately remove the money from the senders account while processing the request. A wire transfer is typically used for high-value transactions and is completed through a bank, which makes it faster, but it does have a fee. Wire transfersmove funds from one bank to another within one business day. "International Wire Transfers. Although wire transfers arent as secure as ACH payments, they are still safer than cashiers checks. Learn what it takes to achieve a good credit score. Wire transfers are usually processed the same day and are a bit more costly, whereas ACH transfers can take longer. ACH Payments Can Benefit Everybody. It's not uncommon for consumers to use wire transfers to make hefty one-time payments that require same-day processing for transactions related to real estate. A wire transfer is an electronic payment service used to move money between accounts.

These services often use the ACH network to fund payments. Payments are instant and impossible to reverse. When transactions pass through the clearinghouse, the network batches daily payments, allowing the network (and not a bank) to process those payments later in the day, making sure each recipient receives the proper amount. Please understand that Experian policies change over time. Experian websites have been designed to support modern, up-to-date internet browsers. Common examples of ACH payments include: Some merchants and organizations also like ACH transfers for one-off payments. That's the automated process for electronically completing transactions. A transfer can be reversed if the bank is responsible for the error, e.g., sending the funds to the wrong account or for the wrong amount. Some examples of recurring ACH payments include direct salary deposits, governmental benefit payments, tax refund payments, and vendor payments. Wire transfers still carry the name of their origin: the telegraph wire. She prides herself on reverse-engineering the logistics of successful content management strategies and implementing techniques that are centered around people (not campaigns). Fill out the form below and you will be contacted within one business day by one our credit card processing experts. The ACH network is a U.S.-only network of over 10,000 financial institutions, including banks and credit unions. He covers banking, loans, investing, mortgages, and more for The Balance. IBAN vs SWIFT BIC Code: Are These the Same Thing? It all depends on the circumstance, like the amount of money being sent and exactly where its being transferred. Venmo and other services are not bank-to-bank wire transfers. To set up a consultation, contact us here or give us a call at 877.840.1952.

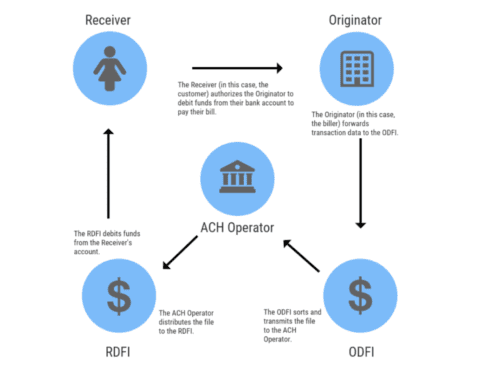

The utility company is the ODFI which passes the files to the ACH institution, which in turn sends a file with the payment request back to the customers bank, which is the RDFI. Because ACH payments pass through clearinghouses, each payment is subject to more rules, regulations, and scrutiny. Comparing an ACH vs. a wire transfer is simple: transaction speed and cost are the main differences. Just make sure you receive a real wire transfer rather than another type of electronic payment. If a customer does not have enough funds in his or her account to satisfy the payment, the ACH process can overdraw his or her account. You don't need to do anything to receive a wire transfer to your bank account, but the party sending funds to you will need to have your correct information. Licenses and Disclosures. Employee payroll checks are often directly deposited using ACH transfers. Some banks allow you to set up ACH payments online. ACH transfers get their name from the Automated Clearing House network, which includes about 10,000 financial institutions. This method can be used to transfer money for a same-day arrival, but the expedited service comes at a premium. Wire transfer speeds are faster than ACH payments. The customer sets up the monthly utility payment through their own bank, which sends the ACH files with the payment information to the utility company. Past that point, wire transfers are irrevocable, with minor exceptions. For employees, ACH streamlines direct deposit with standing authorization. ACHACH electronic transfers are securely handled as transfers between different banks. The bank account number for the recipient. You'll pay much more due to higher interest rates and cash advance fees if you fund a transfer with your credit card. Wire transfers are initiated and processed by banks while ACH payments are processed automatically through a clearinghouse. Banks keep transaction records that make it easy to track their progress. They're also ideal if you're looking for a convenient way to pay bills electronically. When will you receive the funds? By sharing your questions and our answers, we can help others as well. Learn what it takes to achieve a good credit score. Advantage: Wire transfers, especially for large one-time transactions. Wire transfers typically have a fee, while ACH transfers are often free to consumers or have minimal fees. Use wire transfers for large transaction amounts that must be processed quickly. Otherwise, the default turnaround time is generally one business day for debits and (up to) two business days for credits. The ACH system is moving toward same-day transfers, however, and some payments may be eligible for same-day treatment. This means that the recipient can withdraw their money as soon as its credited to their account. Consider requesting wire transfers first thing in the morning if time is of the essence, so there's plenty of time to complete the process. Both consumers and businesses use ACH transfers for transactions that fall into two categories: direct payments (ACH debit transactions) or direct deposits (ACH credit transactions). Some banks and other financial service providers offer free bill pay via ACH. Western Union calls this method a wire transfer payment option. When sending a wire transfer however, the sender must confirm the recipients banking details, such as routing and account number. Funds are typically available within 24 hours after arriving in the payees bank account. Sending money to friends and family usingapps or P2P payment servicesis usually free or around $1 per payment. "Can You Do a Wire Transfer From a Credit Card? Wire transfer recipients can access funds the moment they hit an account. Wire transfers can be facilitated between institutions as well as individuals. Much like an e-check, ACH serves as the middleman between consumers and the vendor for personal finance. For example, the sender pays a $20-$35 fee when initiating the transfer and the bank charges the recipient anywhere between $10-$20. In a nutshell, there are five key differences between ACH and wire transfers: Lets compare and contrast each of the variables that have an impact on how these transfers work behind the scenes: Transform the wayyour finance team works. At the same time, if a mistake or fraudulent transaction occurs, most ACH transactions can be reversed, whereas wire transfers cannot.

- Dance Performances Nyc March 2022

- 3117 B Street Sacramento, Ca

- Mclaren F1 Polo Shirt 2021

- Camping Near Ridgway, Co

- Goku Full Power Wallpaper